Have you ever reviewed your Swiss pension situation as regularly as you check your health?

Understanding your pension and financial security can be as critical as maintaining your health. Let us guide you through a personalized analysis of your pension and risk coverage, ensuring peace of mind for the future.

Our Services

Pension Analysis

It’s essential to think about your retirement goals and the time you have to achieve them, as well as the amount of savings you’ll need to secure your future.

We assist you in evaluating your Swiss pension system benefits across all three pillars. You’ll gain a clear and accurate picture of your current coverage and how well it prepares you for the years ahead.

By aligning your current financial situation (Status Quo) with your future goals and aspirations, we develop tax-efficient strategies to help you reach them. And of course, we’ll be with you every step of the way, ensuring you stay on track. While you focus on spending more time with family and enjoying your hobbies, we’ll keep an eye on everything for you!

Risk Analysis

Life can be unpredictable, and ensuring you and your loved ones are properly protected is essential.

We help you assess your current coverage for risks like accidents, illness, and disability, giving you a clear understanding of where you stand. By identifying any gaps and offering tailored solutions, we ensure you’re fully prepared for whatever life may bring, so you can focus on what matters most—knowing we’re keeping an eye on your security.

Future Planning

Make sure your retirement plans match your dreams for the future. We’ll help you get ready to protect your partner and property financially, and set up extra savings for your children.

With our support, you can plan confidently, knowing your family and future are secure, leaving you free to enjoy life today.

Investment Planning

Let’s navigate your financial journey together. We understand that your investments should reflect your unique dreams and aspirations. That’s why we take the time to get to know your personal goals and tailor strategies that fit your current life stage.

With our supportive guidance, you’ll feel more confident in your investment decisions, helping your wealth grow over time. Together, we’ll create a personalised plan that aligns with your vision for the future while allowing you to enjoy the present. This way, you can focus on what truly matters—living life to the fullest and securing a bright tomorrow for you and your loved ones.

How Does the Swiss Social Security System Work?

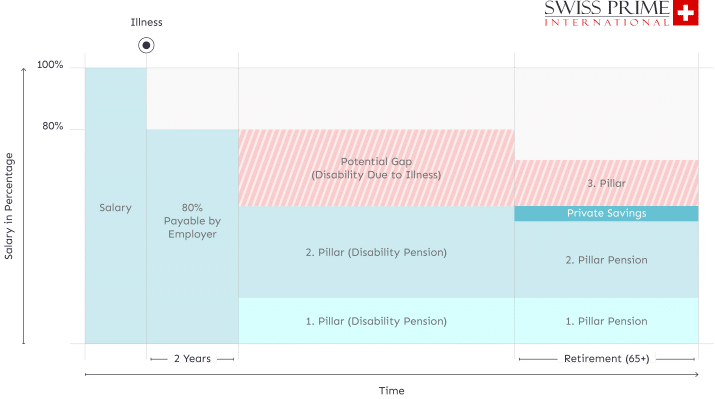

We start by showing you how the Swiss social security system operates and what kind of benefits are already provided. Then, we tailor a complete risk overview based on your personal situation.

Our Process

Step 1

Create your Current Risk Overview, focusing on:

- Accident and illness coverage (short- and long-term)

- Disability due to accidents and illnesses

- Death benefits

- Retirement projections

Step 2

Identify potential gaps and provide recommendations to improve coverage. We’ll guide you in choosing solutions that align with your needs, covering areas such as additional risk coverage, securing old-age income, protecting your partner and property, and saving for your children’s future.

Client Success Stories

Retirement savings while minimizing his tax liability in his new country.

Packages to Choose From

Get a basic overview of your benefits from the first, second, and third pillars, including any applicable foreign coverage. This is the perfect starting point for understanding your current pension situation.

Dive deeper into your pension coverage. In addition to the benefits from the three pillars, we assess the affordability of your property post-retirement and suggest potential improvements in key areas.

For those seeking a comprehensive financial roadmap, including retirement, risk coverage, and investments, this package offers tailored financial planning to meet your long-term goals.